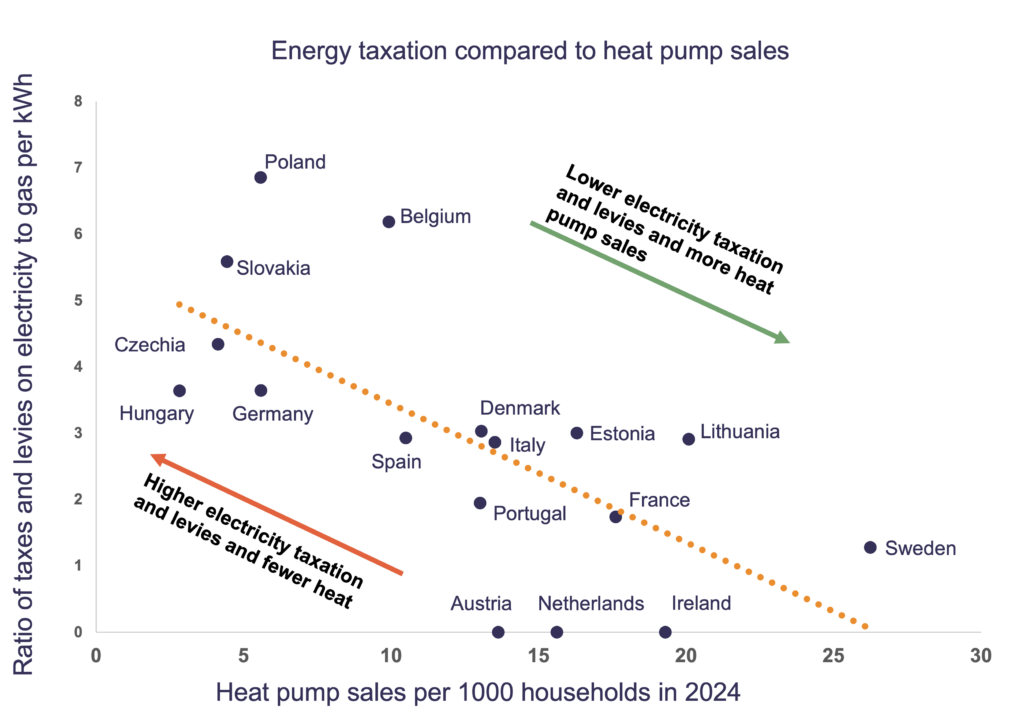

Countries that tax electricity more than gas see slower adoption of heat pumps and are more dependent on fossil fuels, new analysis of a range of European countries from the European Heat Pump Association reveals.

In contrast, countries that ensure electricity is taxed less heavily than gas make heat pumps more affordable and attractive to consumers, and this is shown in the sales figures.

Paul Kenny, European Heat Pump Association director general said:

“Governments use tax to discourage harmful things like smoking. It makes no sense to tax electrification, which we know is crucial for our energy security and the clean economy. Instead, EU countries must shift taxes off power bills and instead put a price on harmful carbon emissions from fossil fuels.”

For example, Belgium has one of the highest electricity-to-gas price ratios in Europe, with electricity costing nearly four times more than gas for households. This is largely due to higher taxes and levies on electricity. As a result, heat pump uptake remains low, with heat pumps having a space heating market share of just 14.7%. This week’s announcement of a taxation change for 2026 that will decrease electricity costs by 3% and increase gas costs by 3% is a good first step to rebalancing cost.

On the other hand, Sweden has long used taxation to support clean heating by heavily taxing fossil fuels and keeping electricity taxes low. This consistent policy has helped Sweden achieve one of the highest heat pump adoption rates in Europe.

Tax shifts should be complemented by lower Value Added Tax levels on heat pumps and electricity, as well as tax incentives for businesses and households that switch to heat pumps and renewable energy.

Click on the graphics below to visualise: