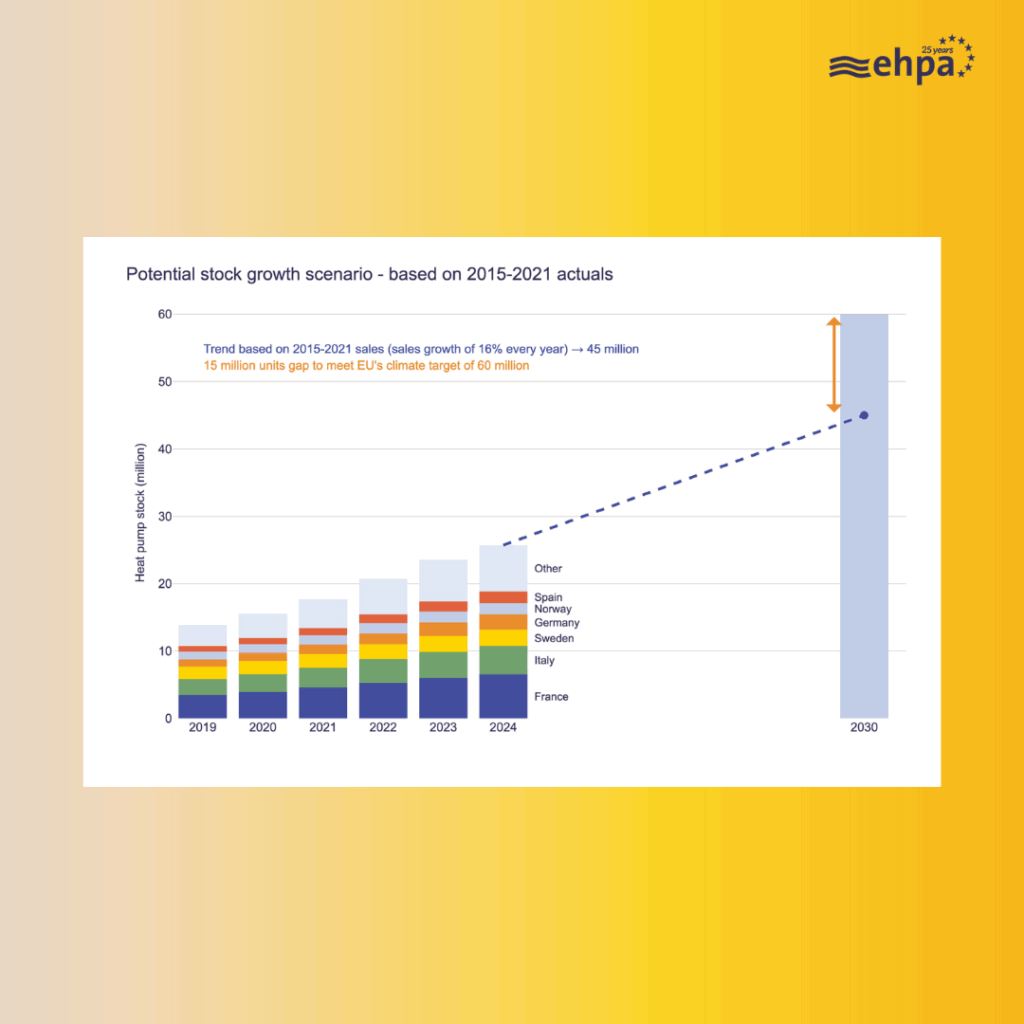

Back in 2022, gas prices had soared following Russia’s invasion of Ukraine, and governments responded by ramping up subsidies and support for clean heating solutions. The EU set a bold target: 60 million heat pumps by 2030.

In total, 2.31 million units were sold across 19 European countries in 2024, bringing the continent’s heat pump stock to roughly 25.5 million.

While heat pumps continue to sell strongly, the market has, in the last two years, fallen below the pathway to the 60 million target.

So, what happened in the meantime?

Persistent inflation, policy uncertainty, and weakened support schemes in several countries all played a role in the slowing sales in 2023 and 2024. Some markets reduced incentives or made them harder to access.

Meanwhile, high electricity prices – especially where electricity costs more than two times as much as gas – undermined the financial case for switching.

The decline in new construction didn’t help either. Fewer new homes means fewer heat pump-ready buildings. Permits for new dwellings have dropped across much of the EU since 2021.

And yet, it’s not all bad news. Countries like the UK and Ireland, which introduced clear polices and well-designed support schemes, saw sales rise exponentially.

EU legislation – like the Energy Performance in Buildings Directive and Renewable Energy Directive – backs heat pump deployment and must now be fully and consistently implemented to help stabilise the market.

Looking ahead, carbon pricing and emissions trading schemes, like the upcoming EU ETS2, together with the Social Climate Fund, which will put a carbon price on heating buildings from 2027, should direct investments toward low-carbon solutions while protecting vulnerable households.

The shift will be strengthened by new market regulation that encourages demand response and energy storage-based business models.

Beyond the climate case, heat pumps also offer strategic value. If just 7% of households switched from fossil boilers, the EU could cut gas imports by 13 billion cubic metres, roughly what Europe imports from Russia for home and water heating. That’s an energy security win as well as a climate one.

A global innovation leader, the heat pump industry supports over 430,000 jobs in Europe, while strengthening local economies – but to keep growing, it needs predictable policy and a fairer electricity-to-gas price ratio.

See more on our new market intelligence public platform, and buy our market report (or become a member and get it for free!) for a truly in-depth dive on prices, sales, technologies, countries, building types and more.