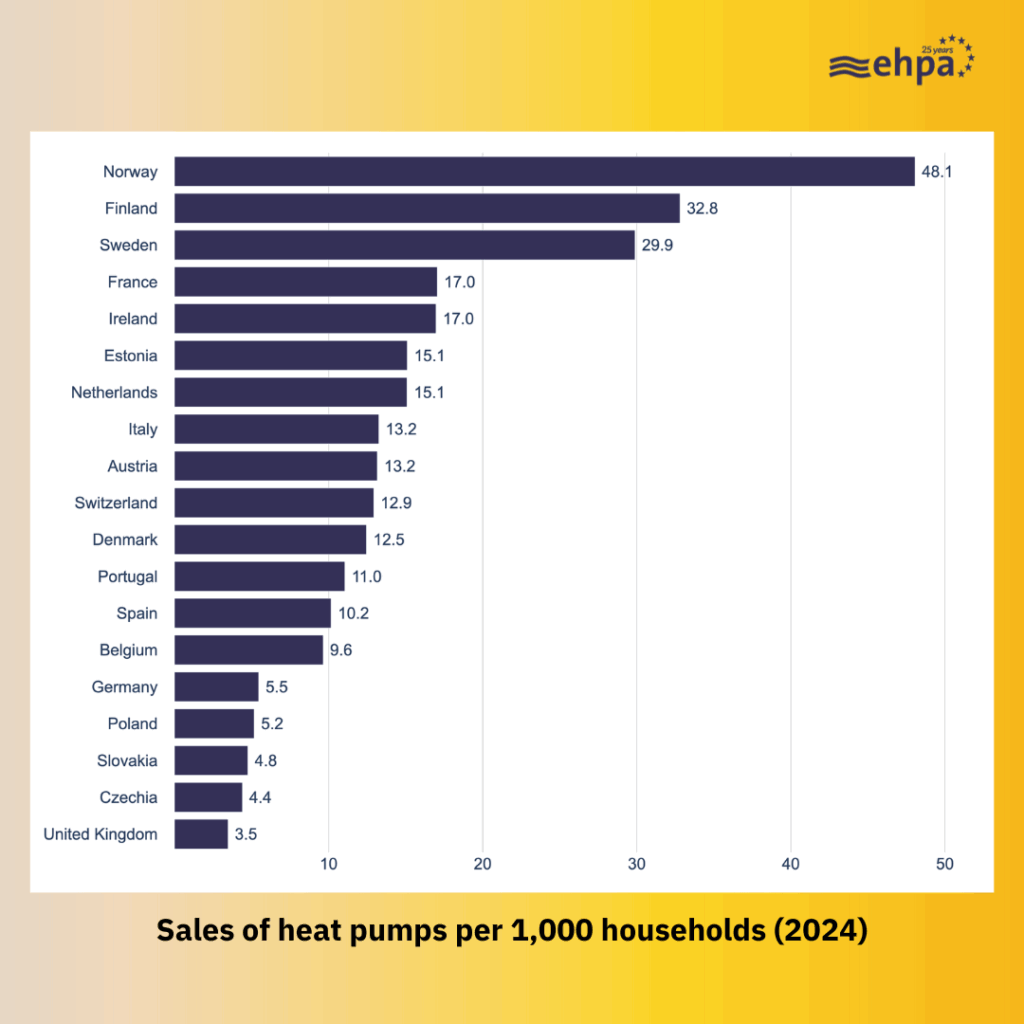

As of 2025, the number of heat pumps installed compared to a country’s population ranges hugely across Europe. This shows that there is still massive potential for greater roll-out.

The top country, Norway, has 632 heat pumps installed for every 1,000 households, closely followed by Finland at 524. What’s more, sales in those countries are still strong, with 48 heat pumps sold for every 1,000 households in 2024 in Norway, and 33 in Finland – the highest levels in Europe.

On the other end of the scale, around 3.5 heat pumps were sold for every 1,000 households in 2024 in the UK – 14 times less proportionately than Norway. The UK now has a stock of 19 heat pumps per 1,000 households. The UK market is, however, one of only three in Europe to have grown last year along with Ireland and Portugal, thanks to a steady support scheme for consumers.

If all 19 European countries covered by the European Heat Pump Association’s 2025 market report had sales rates in line with Norway’s, 10.2 million heat pumps would have been sold. Instead, around 2.31 million were sold in those countries.

The EU’s upcoming pollution tax on buildings and transport (the second Emissions Trading System) – and the Social Climate Fund the revenues will be used for – can make heat pumps and clean options affordable for citizens. If combined with strong support in EU plans like the Electrification Action Plan and the Heating and Cooling Strategy, and the implementation of the 2030 climate and energy laws (‘Fit for 55 package’), the heat pump market will grow.

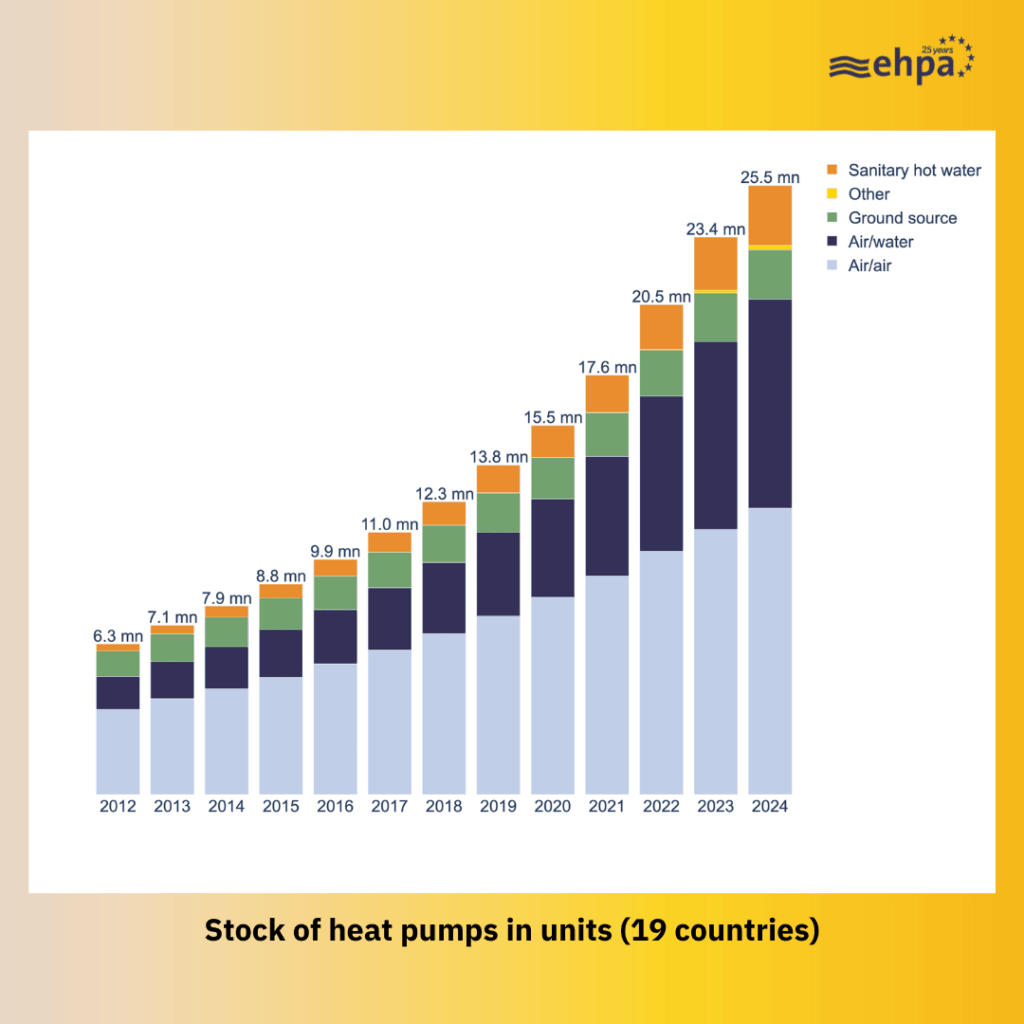

Overall, heat pump sales slowed in 2024 for the second year running, dropping 22% compared to 2023. The additional 2.31 million heat pumps sold bring the stock in those 19 countries to 25.5 million.

Read more about reasons for the change in individual countries and purchase the full report here.

The market report is free for EHPA members (access here), policy-makers and the media (contact Guillaume Uguen).